Calculating Holiday Allowance for Part-Time Employees

Calculating the holiday allowance for part-time employees can be tough. Employers need to work out how much holiday each employee working part time is entitled to, taking into account their specific work patterns. In addition to the general calculations, employers must not forget about any unused holiday allowance and staff absences and pay it out on termination of employment or when an employee leaves voluntarily, this will help avoid disputes in the future. Salary also needs to be taken into consideration and the fact that part-time employees are usually paid less than their full-time counterparts.

The amount of leave outstanding at year-end can vary from nothing if they have been working all 52 weeks, right up to five weeks for someone who has only worked half a year (26 fortnights).

Employers must consider this when calculating much unpaid holiday leave balance is on December 31st each year. Calculating holiday entitlement for different types of employee working arrangements, such as part-time, shift, or irregular hours, is essential to ensure accuracy and compliance. Employers also need to know what type of payment arrangement they use with their part-time employees.

This is usually based on the number of hours worked, or they are paid a fixed salary for all their working hours that week/fortnight, regardless of whether it’s more than 38 (if full time) half days unless they work any additional hours above this threshold. To calculate holiday for part-time and irregular workers, employers must consider the actual days or hours worked to ensure the correct entitlement.

The key takeaway here, though, is how many weeks of leave will be owed on December 31st? The last thing you want to do is underpay your staff when calculating holiday allowance!

This can vary from one to five depending on the arrangement used, so employers need to know what type of payment system has been agreed upon with each employee and calculate accordingly.

There are some exceptions where accrued leave may not need to be considered, but it’s best to check with your lawyer or accountant on this.

It’s also important that you are clear about how much leave is owed, what type of payment system has been used and when the employee can take their leave, so there are no disputes in the future.

The key takeaway here, though, is how many weeks of leave will be owed on December 31st? This can vary from one to five depending on the arrangement used, so employers need to know what type of payment system has been agreed upon with each employee and calculate accordingly.

The last thing you want to do is underpay your staff when calculating holiday allowance! There are some exceptions where accrued leave may not need to be considered, but it’s best to check with your lawyer or accountant on this.

Introduction to Annual Leave Entitlement

Annual leave entitlement is a key employment right in the UK, giving employees paid time off to rest and recharge. For full time employees, the statutory minimum is 28 days of paid annual leave per year, which equates to 5.6 weeks. This annual leave entitlement can be taken at any point during the leave year, and may be expressed in days or hours depending on how the employee works. The number of days or hours of leave an employee is entitled to is usually based on how many days or hours they work per week. For example, someone working a standard full time working week would be entitled to 28 days of holiday per year. Understanding your leave entitlement is essential for planning time off and ensuring you receive your full statutory holiday entitlement. Employers must ensure that all employees, regardless of how many hours they work, receive at least the statutory minimum annual leave, but some companies may offer more generous leave policies. Knowing your annual leave entitlement helps both employers and employees stay compliant with employment law and supports a healthy work-life balance throughout the year.

Legal Requirements for Holiday Entitlement

The legal framework for holiday entitlement in the UK is set out in the Working Time Regulations 1998, which guarantee that all employees are entitled to a minimum of 5.6 weeks’ paid annual leave per year. This statutory holiday entitlement can include bank holidays as part of the total annual leave allowance, or employers may offer them in addition. Employers are legally required to ensure that employees receive their full annual leave entitlement, and failure to do so can result in legal claims or penalties. To avoid errors, it’s recommended that employers use a holiday entitlement calculator to accurately determine each employee’s holiday pay and annual leave allowance, especially for part time or irregular working patterns. Staying up to date with statutory holiday requirements is essential for compliance and for ensuring that all employees are treated fairly throughout the year.

Different Types of Leave

Employees in the UK may be entitled to several different types of leave, each serving a specific purpose. The most common is annual leave, which provides paid time off for rest and holidays. Sick leave allows employees to take time off when they are unwell or injured, while parental leave supports those with childcare or family responsibilities. For part time employees, holiday entitlement is calculated on a pro rata basis, meaning their annual leave is adjusted according to the number of hours or days they work per week. This ensures that part time workers receive a fair share of paid holiday compared to full time colleagues. Employers should have clear policies outlining the different types of leave available and how pro rata holiday entitlement is calculated, so that all employees understand their rights and can plan their time off accordingly.

Accruing Holiday Entitlement

Holiday entitlement begins to accrue from the very first day of employment, meaning employees start building up their annual leave as soon as they start work. Typically, holiday accrues at a rate of one-twelfth of the annual entitlement for each month worked, allowing employees to take their accrued leave at any point during the leave year. It’s important for employers to keep accurate records of how much holiday each employee has accrued, so that everyone knows how much leave they have available. If an employee leaves part way through the year, they are entitled to be paid for any unused holiday they have accrued up to their leaving date. Calculating accrued holiday entitlement correctly is essential to ensure employees receive the right holiday pay and to avoid disputes at the end of employment.

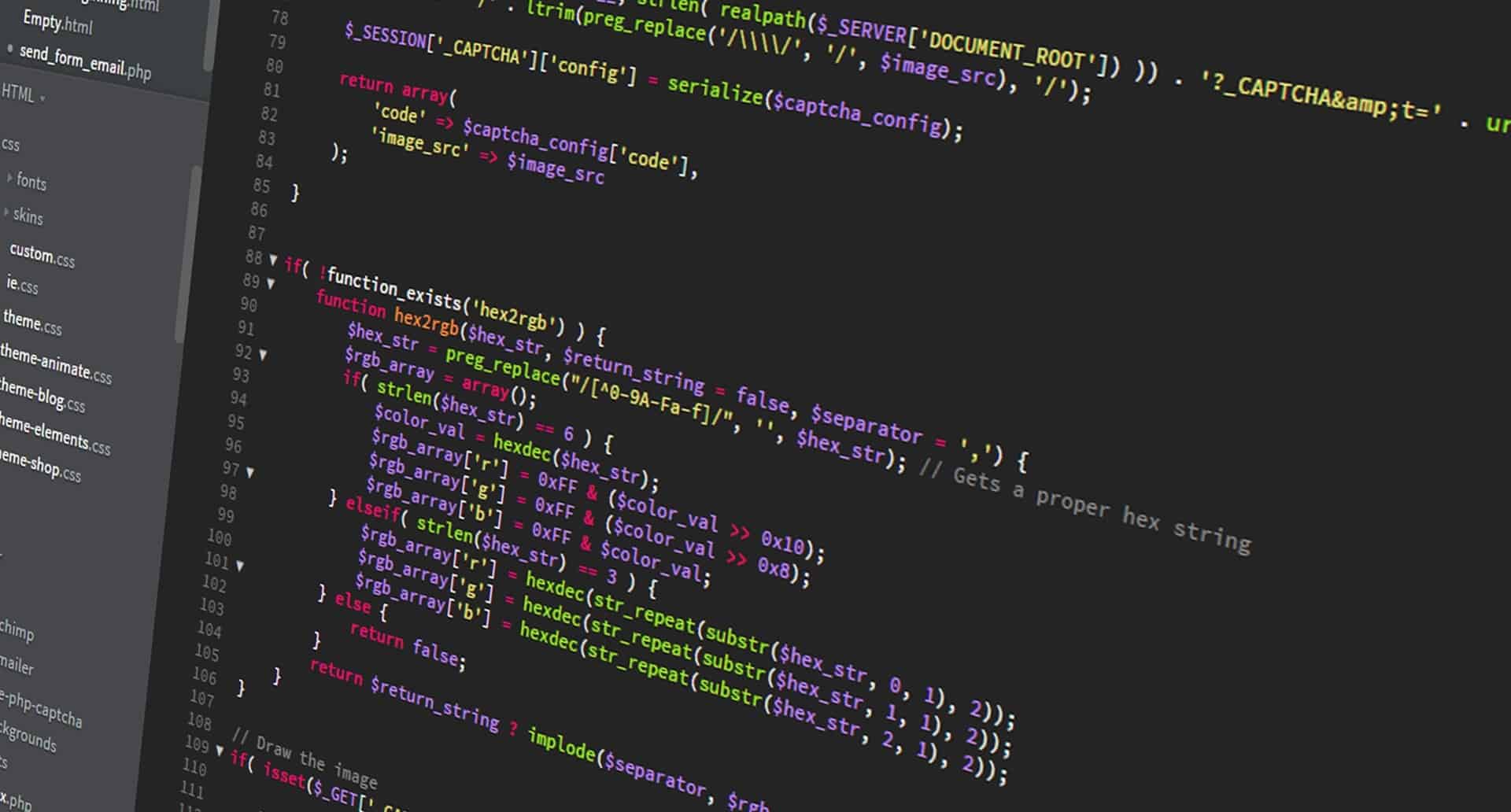

Time for Mathematical Calculations

Employees Who Work Regular Hours

First things first! Even a part-time employee who works regularly are entitled to 5.6 weeks paid annual leave. So, use the factor of 5.6 per year. Now comes the magic formula: Number of days work in a week * 5.6 = days of allowance per year. This calculation gives the holiday entitlement in days for the part-time employee. For instance, Robin works four days a week. 4 * 5.6 = 22.4 days of allowance per year.

Employees Who Work Irregular Hours

If the part-time employees work irregularly, then you have to make the salary calculations hourly, not based on days. For zero hours contracts, holiday entitlement should be calculated based on the average hours worked over a set period, as their work pattern is irregular and fluctuates each week. So, irregular part-time employees are entitled to 12.07% of leave based on the hours they worked.

(The 12.07% of 5.6 weeks’ holiday ÷ 46.4 weeks (52 weeks – 5.6 weeks) x100)

Bank Holidays and Holiday Entitlement

Bank holidays, also known as public holidays, are an important part of annual leave entitlement in the UK. Employers can choose to include bank holidays as part of an employee’s annual leave allowance or offer them as extra paid days off. For part time employees, bank holidays must be given on a pro rata basis, ensuring fair treatment regardless of how many days a week they work. The number of bank holidays can vary depending on where in the UK your business operates, with most regions having eight per year. When calculating holiday pay and leave entitlement, it’s important to use a holiday entitlement calculator to ensure that both full time and part time employees receive the correct number of days off, including any bank holidays they are entitled to. Employers should clearly communicate how bank holidays are managed within their annual leave policies to avoid confusion and ensure compliance with statutory holiday requirements.

Leave Management Software is Value-for-Money Investment

Benefits for part-time employees is an important topic. For instance, using this type of leave management software can help you calculate whether your business makes enough money to support full-time workers or not. Using a holiday calculator within leave management software can automate the process of determining holiday entitlement for part-time and irregular workers, ensuring accurate calculations for each employee based on their working hours and holiday year.

Additionally, having a great place where people can sign up for the specific days that they will be taking off is very helpful in any organisation. The most beneficial aspect of these programs is how they can provide users with so much information when planning daily needs and schedules against their work hours. This leaves them feeling more prepared than ever before!